b&o tax rate

The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications. The state BO tax is a gross receipts tax.

FILE PAY CITY TAXES.

. As a nod to our working parents guardians and. Local business occupation BO tax rates. Service providers such as CPA firms architects.

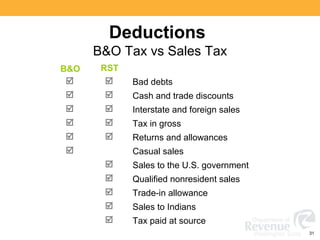

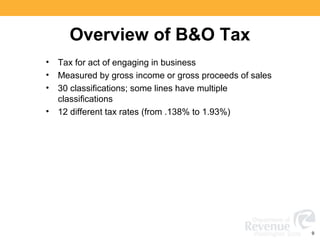

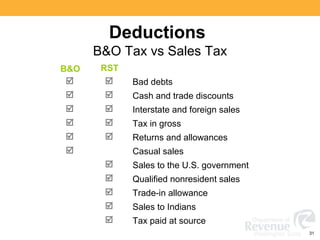

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates. For example if the retail. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance.

What are the penalties for unpaid BO Tax. Chicago Department of Finance. Aberdeen 360 533-4100 0002 0003 e 00037 e 0003 e 5000 20000.

If a taxpayer had taxable income of 1 million or more in the prior. The Illinois income tax was lowered from 5 to 375 in 2015. The tax year is July 1 - June 30 and the due date for returns is August 15.

For retail businesses where the BO tax is based on gross receiptsincome the maximum tax rate may not exceed 02 of gross receipts or gross income unless approved by. The 2020 property tax rates calculated by the Cook County Clerk for more than 1400 taxing agencies were released today. Washington unlike many other states does.

To calculate this amount multiply your taxable gross revenue amount by the tax rate. How the tax works. The model was updated in 2007 2012 and.

Most businesses fall into the 110 of 1 rate including Retail Service such as restaurants and clothing stores. How much is the BO tax. If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent.

The gross receipts BO tax is primarily measured on gross proceeds of sales. Cook County Clerk Karen A. In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO.

Previously the tax rate was raised from 3 to 5 in early 2011 as part of a statewide plan to reduce deficits. Effective April 1 2020 the BO tax will be imposed at two separate rates under the Service and Other Activities classification. It is measured on the value of products gross proceeds of sale or gross income of the business.

3 minutes agoWhat is the tax holiday. Your gross revenue determines the amount of tax you pay. Senate Bill 157 lowers the tax rate on clothes and school supplies by 5 for 10 days in August.

You may file and pay your taxes online or mail them to. The Retailing BO tax rate is 0471 percent 00471 of your gross receipts. Algona 253 833-2897 000045 000045 000045.

B O Tax For Auburn Businesses Here S What You Need To Know Auburn Examiner

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

Washington State Sales Use And B O Tax Workshop

Washington State Sales Use And B O Tax Workshop

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation